The Big Picture : New Money Coming In

In this week's Big Picture series we discuss fresh Chinese stimulus, the powerful rally in global assets and recent signs of weaker data out of the US

The Week That Was

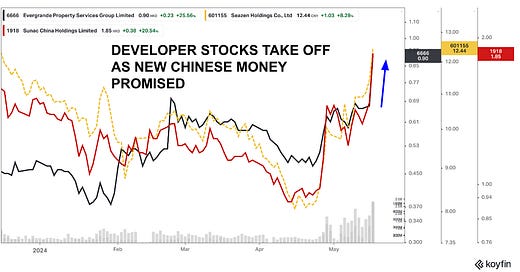

China and the Fed are pouring new money into the global financial system again, forcing all manner of risk assets higher. According to our calculations new housing stimulus measures announced by Chinese authorities this past week on top of anticipated increased bond purchases by the Fed as a result of its reduced pace of QT add up to roughly $250B of new money set to enter into the global monetary system this financial year. Both the Fed and the PBOC are now actively easing policy which indeed is a powerful combination for risk assets in general.

Central Banks

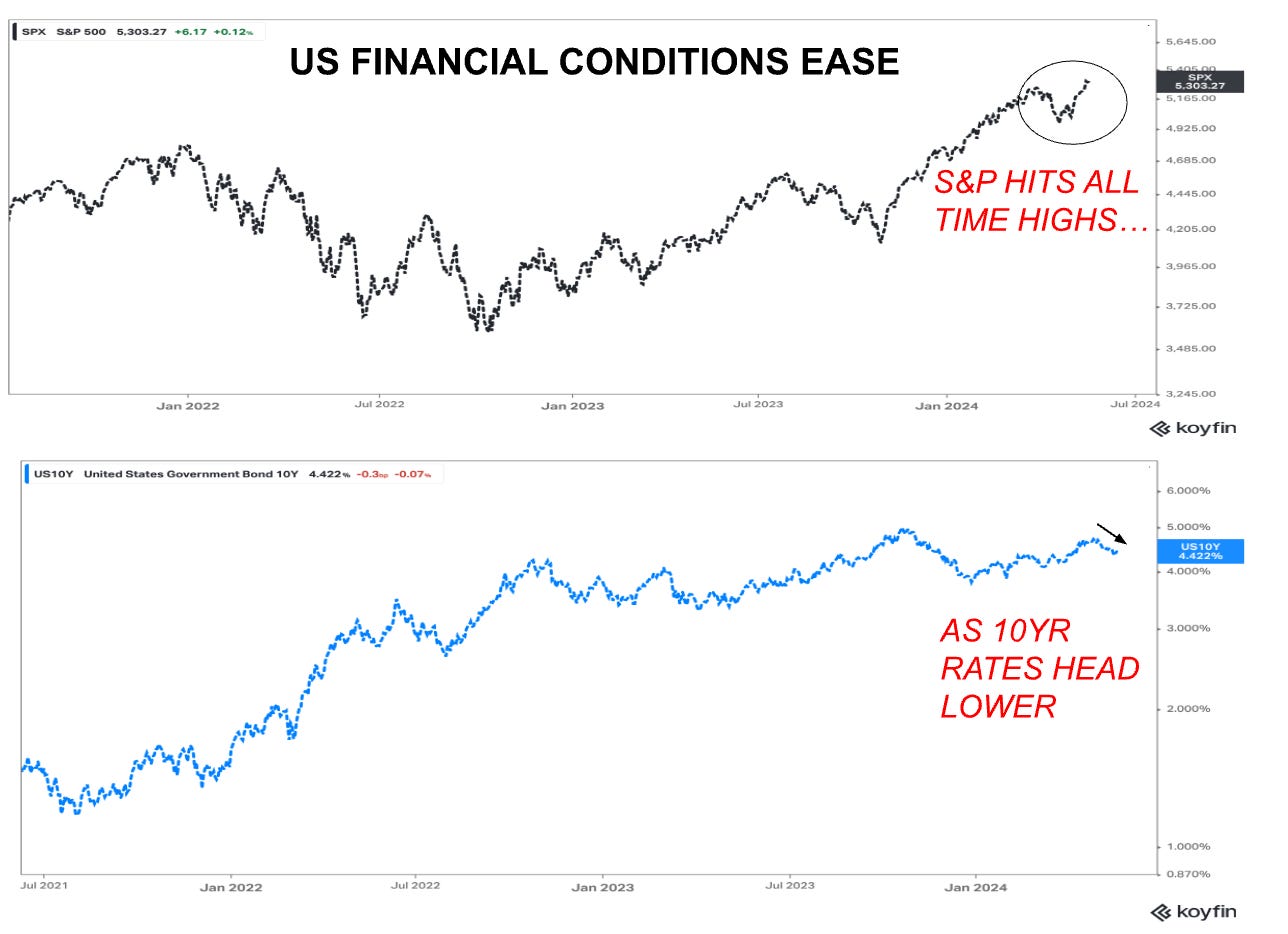

There has been a lot of wrangling in mainstream research about when the Fed is going to start cutting and was the most recent CPI print above or below expectations. This debate is missing the big picture. The big picture here is that the Fed has already begun to ease policy when it announced its decision to taper QT. Recent economic data has all been weak in the US whether you look at the April Jobs report, Q1 Gdp, the Nahb housing index or recent readings on activity PMIs. All indicate a gentle softening in the momentum of underlying growth and that will be enough to ensure that some form of easing keeps being administered by the Fed over the course of the remainder of this year.

Final Word

While the recent downdraft in growth indicators out of the US is somewhat concerning at this point it is unlikely to be sustained. The market’s experience since 2022 has been that each patch of weaker economic US data out of the US has been accompanied with a dramatic easing in financial conditions via both long term interest rates and a rise in the equity market. A similar dynamic now is again underway and if recent gains in equity and bond markets are sustained, I expect the recent set of weaker data to be again part of a “patch” rather than indicative of something more permanent.

As always we shall keep you posted here at Purity Macro.

If you enjoyed this post, please be sure to like, comment or share the link with a friend.

You can also now follow me on notes : @puritymacro

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.

It is ironic that Chairman Powell continues to tell us that current policy is somewhat restrictive despite the ongoing flood of liquidity in the market. I guess it helps him sound like an inflation hawk, which is critical politically given Biden's problems and the surveys showing inflation is a major problem. But, I agree, there is no evidence that things are going to weaken dramatically.