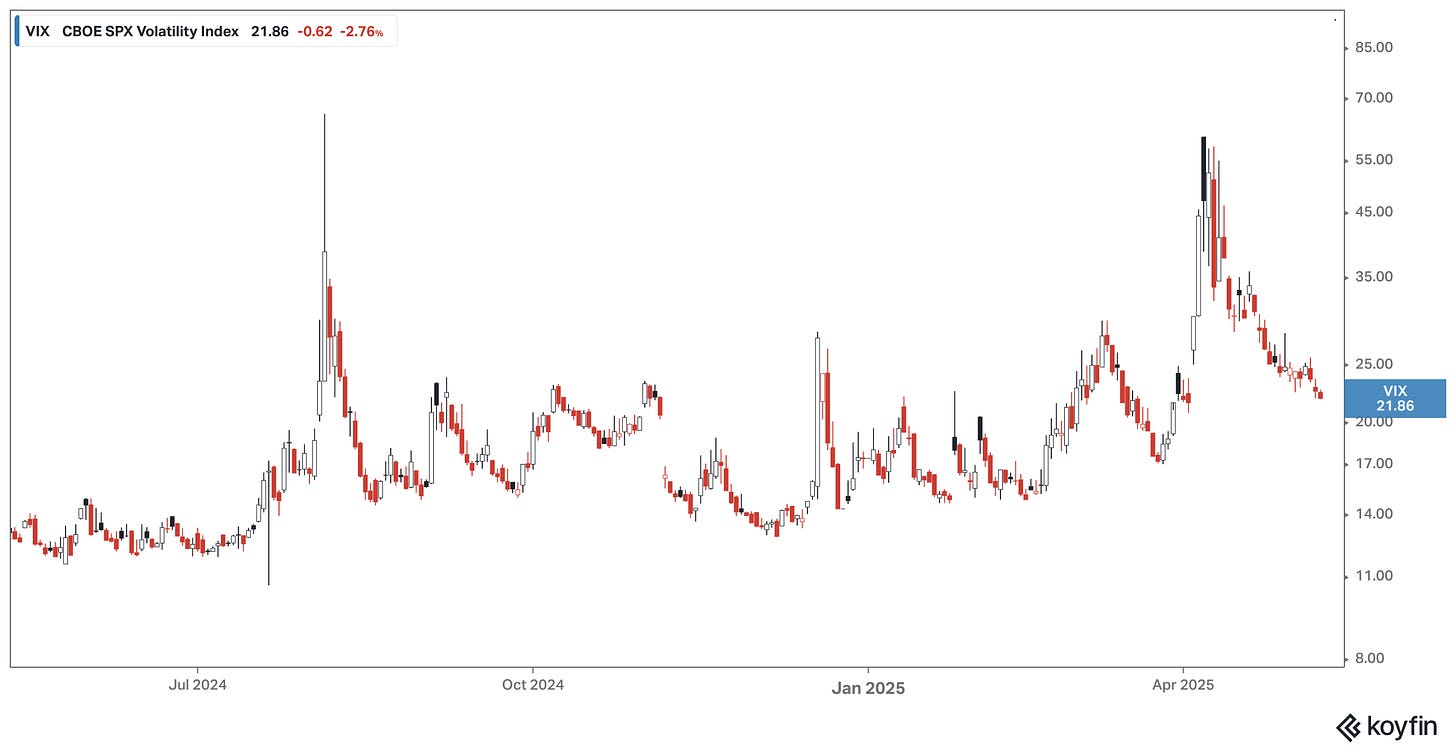

VOLATILITY CONTINUES TO DECLINE

This Week

Fed: Non comital as market continues to price in an easing cycle. 100bps worth of cuts priced in out to December 2026. Terminal rate of around 3.25%.

ISM Services: Rebounds somewhat to 51.3 but still overall subdued relative to pace seen at the start of the year.

Oil: Dramatic flattening of the curve seen, with futures prices hovering around $60.00/barrel although the way out to 2027. This sort of stability has not been witnessed in oil markets for some time.

Usd: Dxy Index rebounds back above 100.00, squeezing short positions post Fed. Eurusd back under 1.1300, Usd/cad flirting towards 1.4000, Usdcnh 7.2405 up 300 pips on the week.

Equity Vol: Vix index continues to decline broadly down towards 21 this week

Btc/Usd: Bitcoin currency trades to new highs, cracking 100k, trading at 103,780 right now, +0.77% on the day.

Solana/Usd: Solana currency begins healthy rebound from doldrums.

Healthy Rebound in Solana currency

Upcoming Week : US Data

Us core inflation (0.2 expected),Crude Oil stock,Us Retail sales(-0.1 expected),Philly Fed

Powell Speech, Industrial Production, Manufacturing, TIC Flows(key to observe Asian central Bank activity in treasuries).

Good Luck on the Week.

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.