US Recession watch

Spx trades 1.5% lower, treasury curve steepens and currencies that correlated negatively to US growth fears such as the Canadian Dollar and the Swedish Kroner trade weak.

Today’s move is sparked by a significantly weaker than expect US manufacturing PMI and comments from Fed Chairman last night indicating that he feels that the current restrictive level of interest rates is now being felt throughout the economy

Major disparity however remains between relatively weak anecdotal data versus real activity data such as Q2 Gdp growth.

If real data were to now start significantly weakening from here, Fed would be open to cutting 50 at the September meeting.

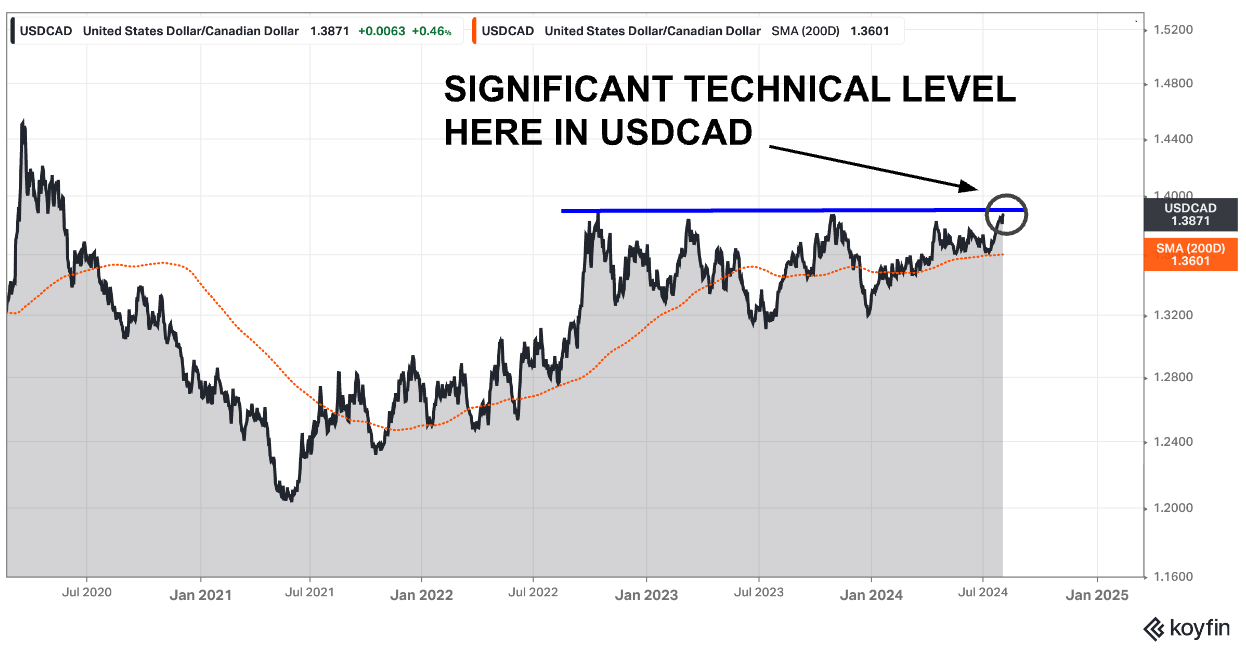

Cad:

Canadian Dollar trading very weak going into tomorrow’s US jobs number with the Usd/Cad spot now at 1.3880, flirting with levels that have coincided with what looks like a quadruple top on the charts.

Boc has led easing in North America and CGB curve also is currently leading US steepening bias.

US recession fears could potentially further cause Cad weakness as Boc now tries to not only stave off domestic economic weakness but could start importing slowing growth and exports from the US

Eurozone Cpi - Ecb Policy

Hicp monthly print for July comes in at 0%. Overall inflation heading in right direction with annual rate still elevated due to the inclusion of a 0.5% print from August of last year, which will dropout next month.

As long as Augusts Hicp print comes in at 0.3% or below, Headline will definitively drop below 2.5%….giving Ecb the all clear to cut in September. Ez Gdp growth is annualizing below 1.5%...it’s weak. Ecb needs to cut again.

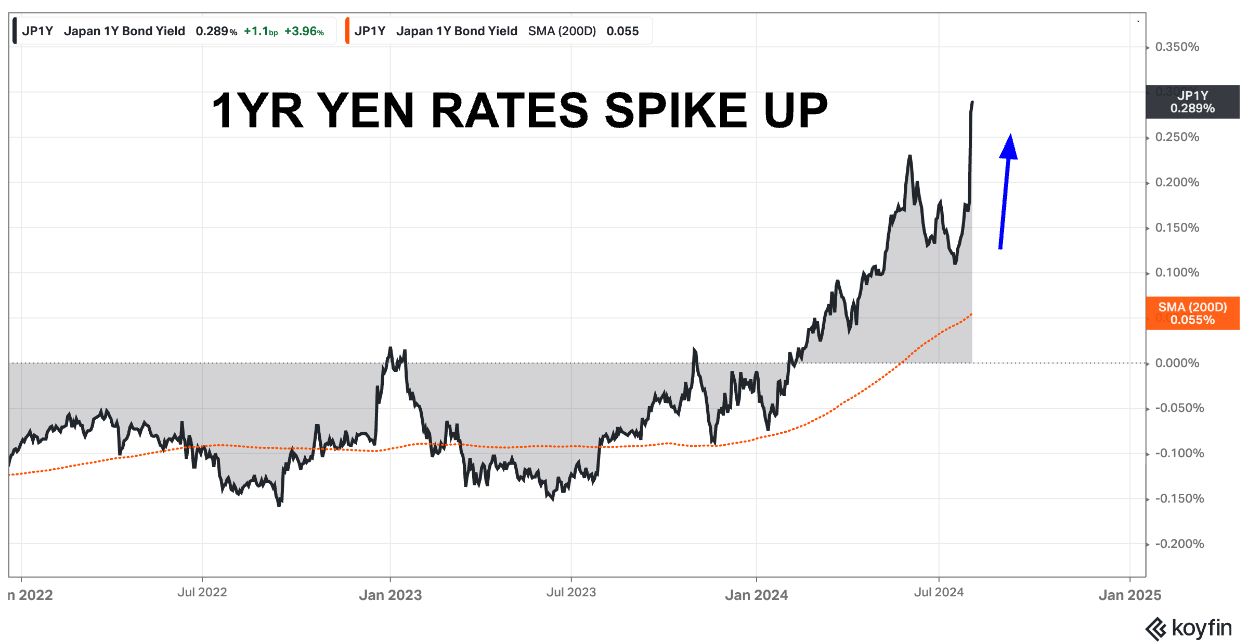

Jpy Rates

Short end rates spike up about 15 bps after BOJ hikes the overnight rate from 0.1% to 0.25%.

Long end rates are better behaved as Boj Bond tapering schedule that was announced is very gradual.

The central bank is targeting to reduce bond purchases from the current pace of 40B USD equiv/month to 20B USD equiv/month by 2026.

Current Jpy strength is being driven by spec position unwinds as authorities forcefully sell dollars and buy Yen in the FX market during periods where the dollar would already be trading weak…for example post a weak US Data release…or after a more hawkish than expected Boj outcome.

This strategy is working as Usd/Jpy now sits just below 150…trading some 200 pips below the 200d moving average.

All eyes now on the US nonfarm payrolls number tomorrow.

As always, I shall keep you posted here at Purity Macro.

If you enjoyed today’s post please be sure to like, comment or share the link with a friend

You can also now follow me on Substack’s notes : @puritymacro

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.