Macro Notes

In today's edition of Macro Notes we discuss technicals on the dollar, outlook for 10 Yields in the US and some thoughts on Chinese macro volatility.

Us Fixed Income

US 10 year yields seem to be hovering either side of 4% as markets balance potential monetary easing by the Fed against a re-acceleration in growth dynamics. There is also now some anecdotal evidence that elevated shipping costs are indeed feeding into supplier prices. Although freight shipping indexes seem to be finally rolling over, I fully expect the more than 300% rise in these indexes to impact both goods and services related inflation over the next couple of months. The effect should be short lived but it could be one of the reasons the Fed has decided to push back on delivering a cut in March.

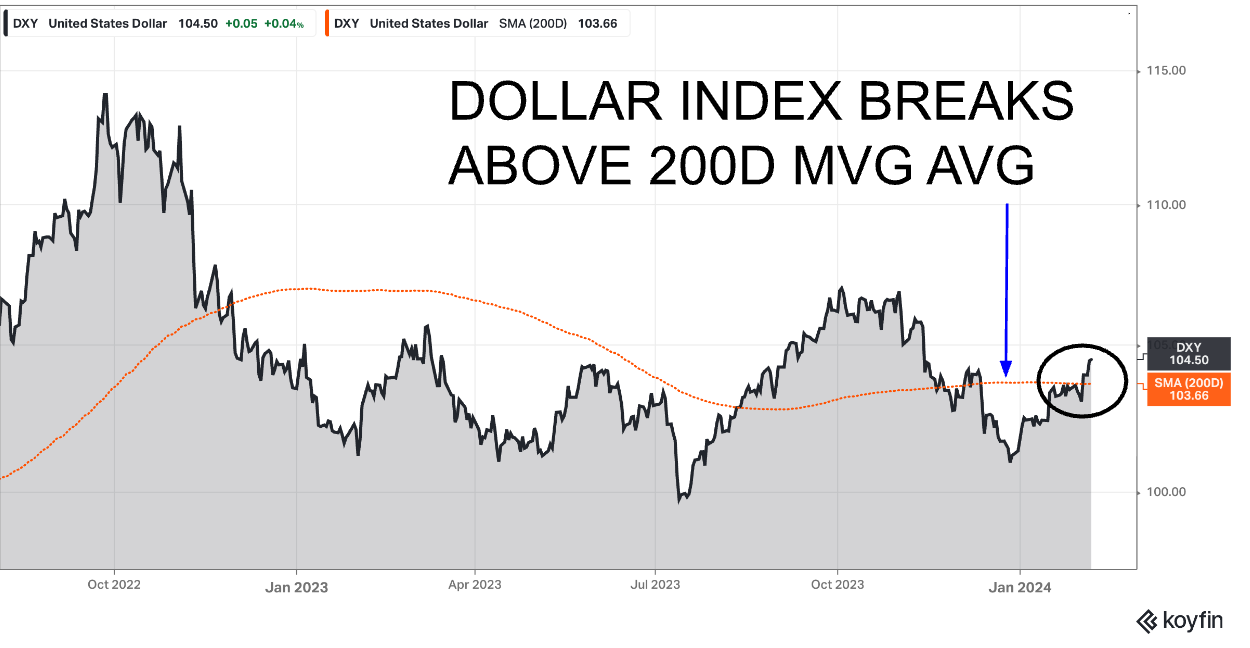

The Dollar

The Dollar index has been trading well these past few trading sessions as we break above some key technical levels. Good news on the treasury borrowing front (as discussed in last weeks macro notes) and strong economic data are pushing the dollar up and I expect funds following quantitative momentum signals to begin accumulating dollars. The rally is likely to face some stiff resistance from Asian authorities however as both Chinese and Japanese authorities will dislike further weakness in their currencies. As Usd/Jpy approaches the 150 level and Usd/Cny approaches the 7.25 level, we should expect growing verbal and actual intervention.

China vs the World

The situation in China continues to warrant our attention as authorities grapple with a rapidly declining equity market, malaise in the real estate sector and poor business and consumer sentiment. Crackdowns on shorting equities, cuts in reserve requirements and allowing certain government entities to begin accumulating Chinese equity ETF’s may help on the margin but at this point, global markets will look for decisive action by both the government and the central bank to underpin confidence and kickstart a virtuous cycle towards higher growth and stock prices.

As always, we shall keep you posted.

If you liked this post please like, comment or share with a friend:)

You can also follow me now on X. My handle is @moali18.

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.

Hey Mo - do you think Chinese equities will bottom out anytime soon? Know the Government has taken some action but definitely haven’t taken a money bazooka to it. That said, down $7 trillion there’s gotta be an end in sight.