Macro Notes

In today's Macro Notes we talk about the rising correlation between Gold & S&P 500, preview tomorrow's Core PCE number and discuss our outlook for the Yen.

Gold and S&P 500 : Increasingly correlated

The price of Gold and the S&P 500 both continue to trend up this week with correlations between the 2 asset classes becoming increasingly tighter.

As the Federal Reserve suppresses the yield curve, the demand for hard assets and inflation hedges is increasing, further exacerbated by the recent inflation upswing. When asset correlations begin to trend this closely together, it may be indicative of not only increasing liquidity in the market but a potential warning signal that bubbles maybe forming. These asset trends are likely to continue however until there is a significant growth shock to the economy or the Fed starts to become more concerned about inflation.

Core Pce Preview

The Fed’s most watched inflation gage is set to be released tomorrow, a report keenly anticipated by markets given its importance to the Fed’s overall outlook.

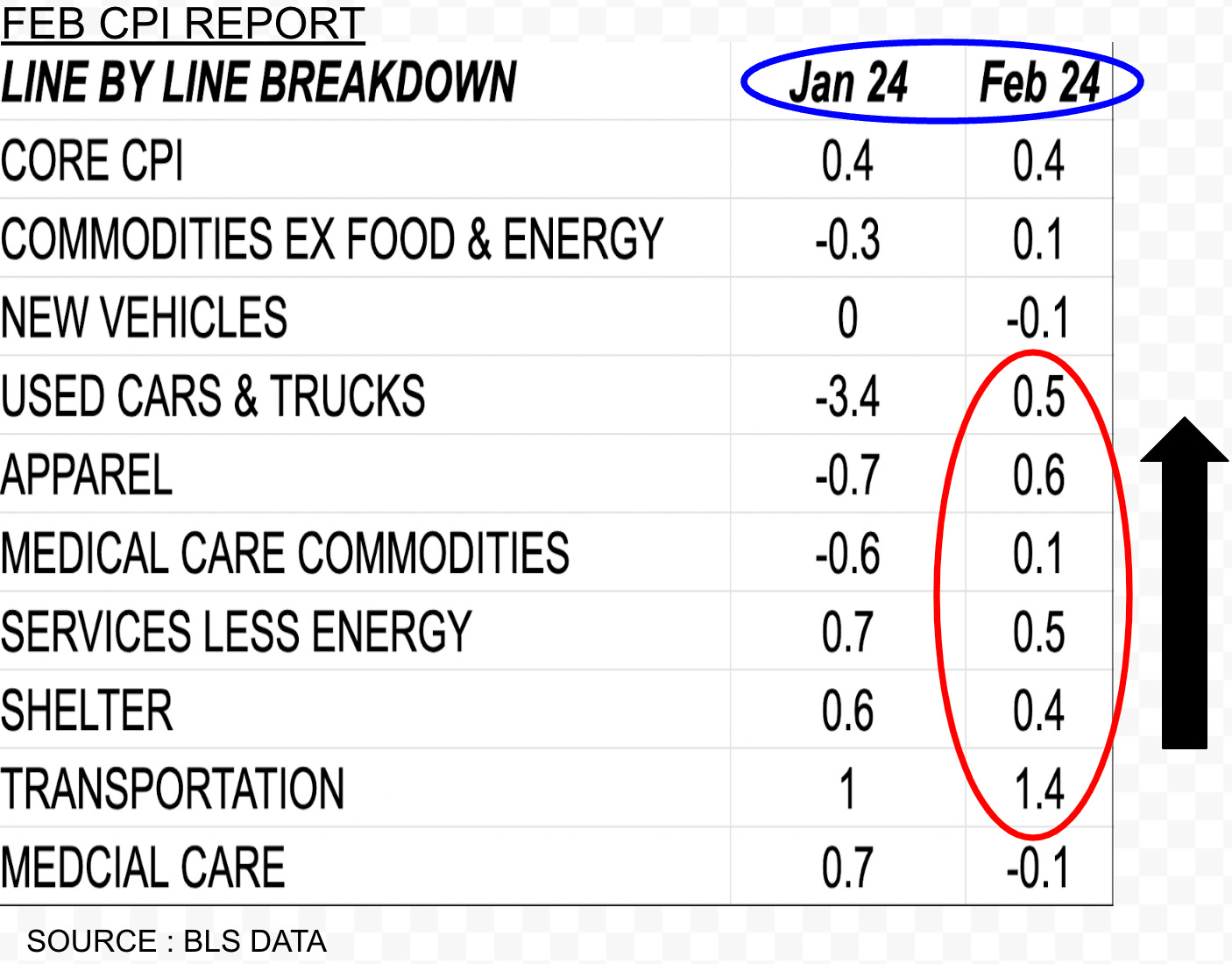

If you recall, the preliminary CPI report for Feb was released a couple of weeks ago and rose a healthy +0.4% on the month. Gains in core CPI were seen in almost all components with notable price reversals in used cars and apparel prices. Shelter costs remained firm and transportation service prices are now surging coming in at 1.4%, in part driven by rising prices at the fuel pump.

Similar CPI component trends should also be present in tomorrow’s core PCE report which is forecasted to come in up a milder 0.3%. There is some upside risk however to that forecast in our view.

January’s core PCE print came in at +0.4%, similar to the rise in core CPI which was also +0.4%. If the 1 for 1 correlation between these 2 measures is again prevalent in tomorrow’s Feb PCE report, then we fear the annual trend based on the last 6 months readings will notably worsen as far as the Fed’s outlook is concerned.

We calculate an underlying core PCE rate of close to 3%, on an annualized basis, if Friday’s monthly change comes in at +0.4% and 2.8% if it comes in as forecasted at +0.3%. Neither outcomes are friendly and will keep the Fed firmly on the sidelines for at least the next 3 months OR until the current upswing dissipates.

Thoughts on the Yen

The Ministry of Finance in Japan has been forced to threaten FX intervention in currency markets as Usd/Jpy attempted to move past the 152 level. The Yen has been under pressure ever since last week’s BoJ meeting which overall disappointed market expectations. Japanese yields have subsequently moved lower and the money market futures curve now only prices in a very mild tightening cycle for Japan which, if realized, would still keep the interest rate differential firmly in the US dollars favour. This reality now puts Japanese authorities in a bind. If they don’t tighten policy more aggressively, selling pressure will remain on the Yen. While the Yen remains weak, imported inflation is likely to remain elevated.

At the same time the market is unlikely to take on the MOF which boasts a treasure chest of a trillion dollars in reserves which could be used to defend the currency if needed. A stalemate in the FX market is now most likely, with Usd/Jpy increasingly confined to a 150/152 range until further clarity arises.

As Always we shall keep you posted here at Purity Macro.

If you enjoyed this post, please be sure to like, comment or share the link with a friend.

You can also now follow me on X : @puritymacro

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.

Regarding the yen, I have to disagree. inflation is a political issue, not an economic or financial one. from everything I have read (albeit I am not on the ground there) it does not appear that there is a huge uproar over the fact that inflation has moved from 0% to 2%. the weaker yen is clearly impacting that, but remember, Japan is still largely a mercantilist country and a weaker exchange rate helps it greatly. Mr and Mrs Watanabe are long stocks and happy with the current situation. while I think the MOF is concerned about a sudden collapse, and we will hear a great deal of jawboning, if we grind to 155, my bet is they will not enter the market. Clearly anything can happen, but absent a yen crash, there is more pressure on China as the CNY strengthens relative to the yen, than on Japan in my view.