Global Risk Markets:

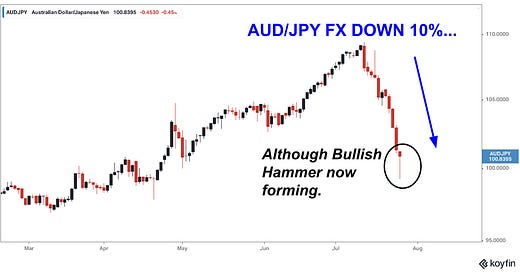

Aud/Jpy declines 10% from the highs as the cross posts a major bullish hammer pattern in today’s trading.

Asian equity weakness contributes to the selloff in this Asian risk FX pair as global risk markets themselves try to stabilize.

The Vix Index spiked up to 19 yday but reversing sharply now back below 17.

Nikkei corrects 10% as well and now sits on major technical support ahead of 37,500.

Us Curve Steepening/Boc Rate Cuts:

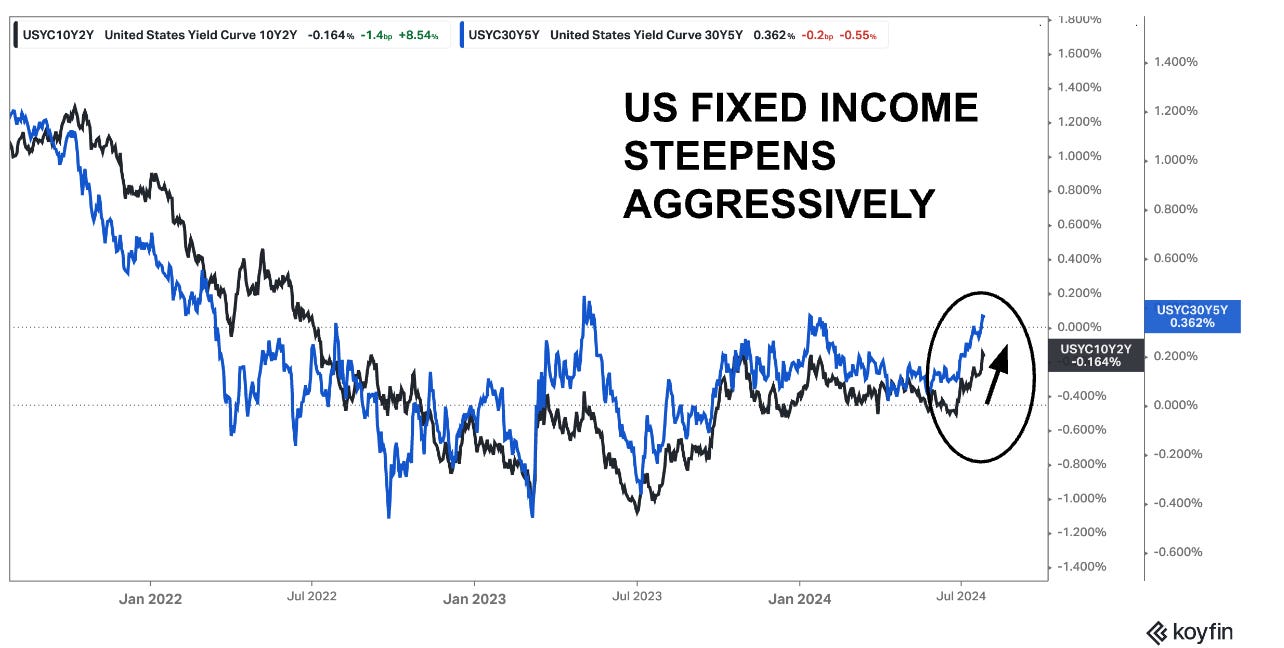

US 2s10s steepens 35 bps and US 5s30s has steepened 15 bps in the last 4 weeks as weakening US data and recent global equity market corrections bull steepen curves, imposing subtle pressure on Fed to deliver first rate cut.

Bank of Canada boldly delivers back to back rate cuts despite a bad inflation print in May adding to overall steepening bias in North American bond markets.

Canadian risk markets outperform global averages, despite Cad FX weakness, as domestic markets welcome aggressive action by the Boc.

Ecb tentative / Kroner weakeness

Ecb hasn’t pre-commited to a September rate cut as market now awaits July’s flash Cpi estimate in order to gage the next move.

Lack of commitment on Ecb’s part, combined with general shaky global risk sentiment has led to a dramatic weakening in both the Norwegian and Swedish kroner. (See chart above).

Both Eur/Sek and Eur/Nok are now testing key technical levels at 11.75 and 12.00 respectively.

Recent kroner weakness will not be welcomed by domestic central banks as the speed of the adjustment can create disruptions in the short term inflation outlook making it difficult to ease policy.

Ecb is however likely to deliver a rate cut at its next policy meeting despite their opacity which should calm volatility in European peripheral currency pairs and European risk markets in general.

Looking Ahead…

Summer markets and liquidity conditions have perhaps further added to the speed of the depreciation in global risk markets and Scandinavian currencies.

All eyes now on tomorrow’s US Core Pce number for month of June

As always, I shall keep you posted here at Purity Macro.

If you enjoyed today’s post please be sure to like, comment or share the link with a friend

You can also now follow me on Substack’s notes : @puritymacro

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.

With USDJPY bouncing today, are we likely to see a reprieve in the short term? I feel like that has been the driver quite frankly

Interesting comments on the exchange rate between the euro and the Scandinavian currencies.