Financial markets have witnessed some extra-ordinary volatility in the past two weeks.

This is sometime inevitable when markets are forced to contend with multiple factors that could have significant implications for the macro-economy as a whole.

The geo-political situation currently rests on a knife’s edge.

Japan, having dragged their feet for months on monetary policy now suddenly find themselves tightening policy into the eye of a global economic slowdown.

China seems to lack the tools or the will to forcefully jump-start it’s ailing domestic economy while both Europe and the US possess a desire to provide monetary support but are hampered by inflation rates that remain somewhat sticky above 2%.

US politics further add to uncertainty while markets remain nervous about corporate earnings ability to deliver the growth required in order to justify the outsized gains in stock prices we have seen so far this year.

Economic data, particularly in the US, continues to frustrate economic forecasters as it still remains unclear which direction the economy will take in the coming months. Real GDP growth rates coupled with headline inflation indicate a run rate on nominal GDP which could justify current equity multiples in the US. But certain key data points such as a component analysis of Pce price data and trends in the job market indicate that a softening in both price pressures and economic activity is now underway.

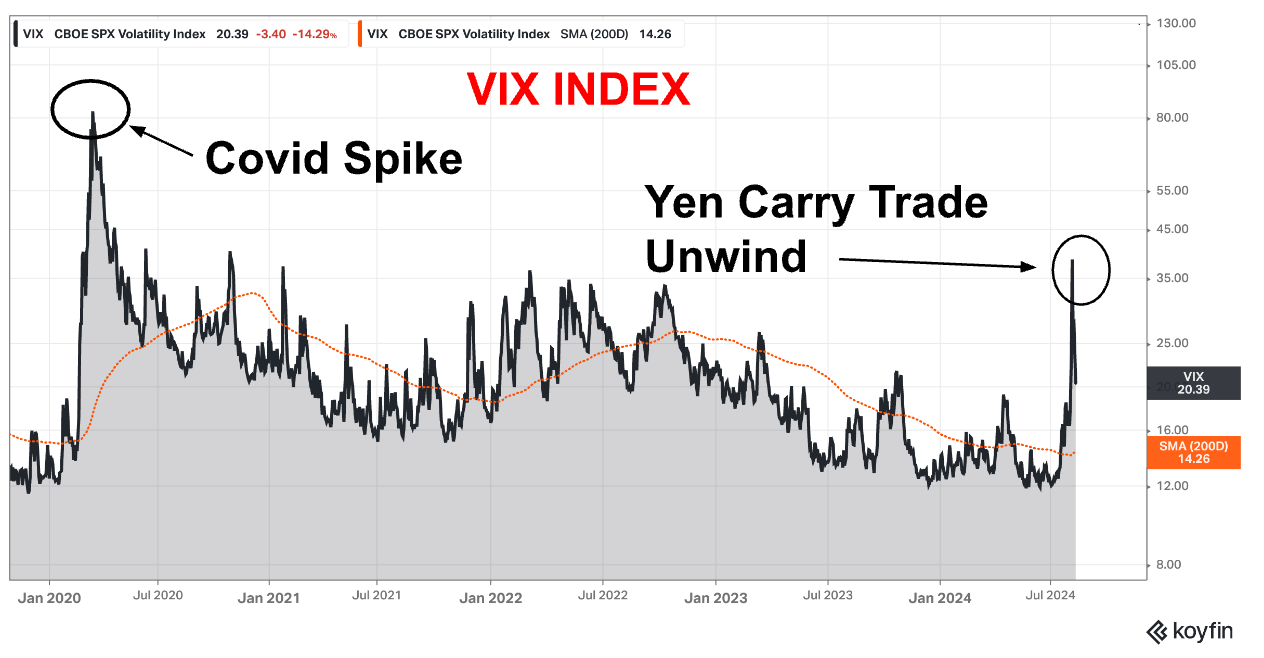

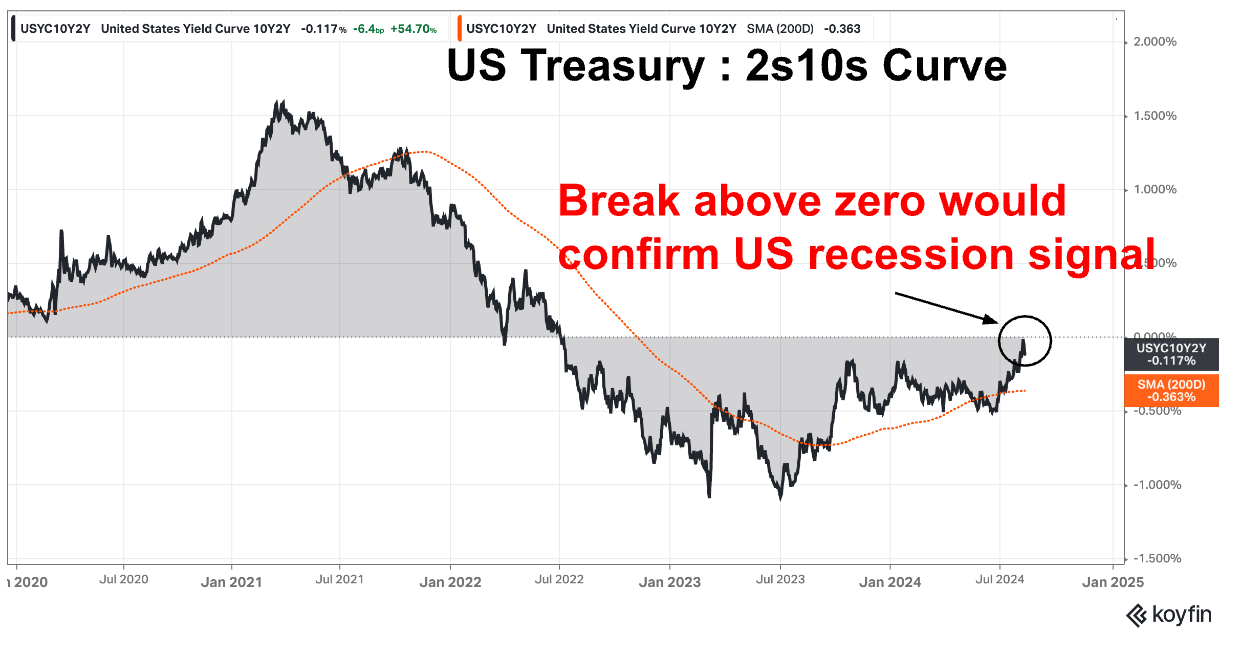

Macro assets that are particularly sensitive to inflation, growth and Fed policy have already begun to price in a high probability of a US recession. Popular indicators such as the 2s10s US yield curve, Yen FX carry trades, and the VIX index have been flashing warning signs and these have become difficult to ignore as their adjustment velocity have recently picked up.

The pickup in volatility itself, coupled with an Asian deflation threat and political uncertainty could be enough to set in motion a self fulfilling and meaningful slowdown in the US economy.

It is the Federal Reserve’s job now to steer the ship with poise and precision when waters become choppy. And they are indeed getting choppy.

Forward looking signals flashing amber for rate cuts must be acknowledged without re-igniting inflationary pressures. The Fed must begin to easy policy soon, remain vigilant on inflation and be detached from politics. This is no easy feat and markets know it.

Expect markets to remain choppy through August as changes in any one of the many factors currently affecting the world economy will have significant implications for asset prices…..during a period which historically tends to be illiquid in financial markets.

As always, I shall keep you posted here at Purity Macro.

If you enjoyed today’s post please be sure to like, comment or share the link with a friend

You can also now follow me on Substack’s notes : @puritymacro

Disclaimer

The information provided in this post is for general use only and does not constitute a solicitation for investment. It should not be construed as professional financial advice. Seek independent professional consultation before making an investment decision.

"It is the Federal Reserve’s job now to steer the ship with poise and precision when waters become choppy." Perhaps this is the key problem. they have assumed this mantle but have shown they are not equipped to manage things properly. I wholeheartedly agree that more volatility is coming